by David Metter

Every New Year is accompanied by a revitalized, fresh new wave of energy. It’s exciting to hit that reset with button with a renewed sense of faith as we reassess our goals and make changes to be better. I believe 2018 in particular will be a year of overflowing opportunity, unlike any other. I say this because when it comes to both digital marketing and dealership operations, we’re starting off the year with a very powerful weapon that will eliminate instances of both assumption and uncertainty.

A calm quiet will take over the imperious noise of opinion. It will shatter the fear of the unknown and replace it with the confidence of proven science. Instead of basing decisions on what you think, you will improve your business by what you know.

Data is what is known. Data is rooted in science and in proof. Data is truth. And let me be clear, there is no escaping the truth that your dealership’s sales data will bring to the surface once it’s seen from all angles. Believe it or not, the value of the data that lives within your CRM and DMS has infinite potential to improve the way you operate. It’s all about looking at that data through the right lens in order to get a new, better, multidimensional view.

At Urban Science, we’re incredibly fortunate that we can take the data that resides in your dealership and break it down into 4 simple buckets that you can actually wrap your heads around, so that you and your vendor-partners can take real action.

- Lead Source

- Model

- Geography

- Salesperson

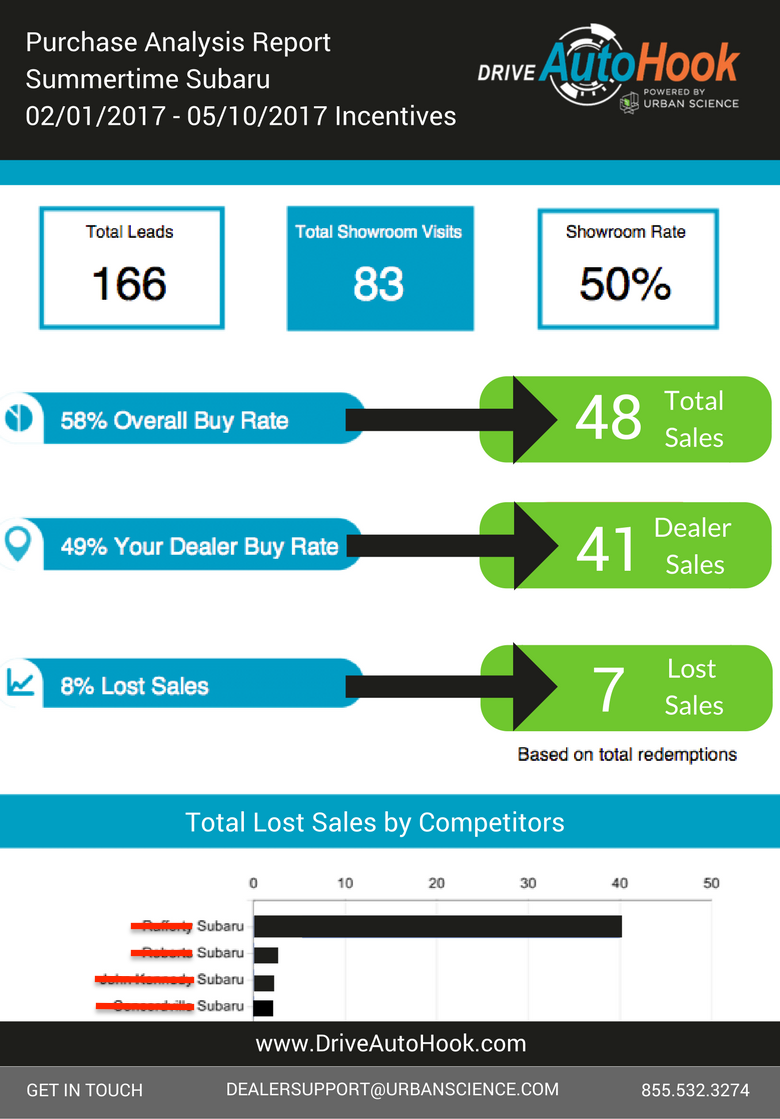

Because of the sales data we get every single day, we can infuse both sales and defection trends on top of every lead that hits your CRM in near real time. Not only do we look at the sales within any given dealership, but we also look at the sales that happened outside of that dealership. Then we use that data to evaluate trends, triumphs, and defeats within their processes, related to the four buckets listed above. That last one (salesperson performance) is especially exciting. Never in my career has there been a way to look at the true effectiveness or ineffectiveness of a dealership’s salespeople.

All of a sudden when you can see your data from this utopian, comprehensive perspective, you start to also see what you’re losing within the opportunities that you PAID for, driven by the traffic hitting your CRM. When you can see trends of effectiveness or ineffectiveness (success and failure), you then have the power to make changes that will make you better in all four of those buckets. Whether you’re working with a training organization, adapting to new advertising initiatives, or even changing pricing within your inventory, you can start making decisions based on factual truth, which will ultimately benefit all parties involved.

So instead of running your business hindered by fear of the unknown, the right data will give you the power to flourish in the light of certainty. Until now, dealers have been lost in the dark when it comes to the trends or holes in their processes simply because of a lack in the quality of sales and defection data at their disposal.

I’d also like to make it very clear that CRM and DMS companies are NOT at fault because they do what they do really well. It’s just a matter of infusing the right information into your system, much like what you see with data and analytics companies that integrate into Salesforce, the largest CRM company in the world.

As you set new goals and make changes for 2018, remember that data doesn’t lie and not even your #1 salesperson can hide from it. Data has proven time and time again that all those leads in your CRM who are marked as “did not buy” actually did purchase, and in addition, we know what they bought, when they bought, and where they bought. That information becomes super powerful – sometimes more powerful than we can even understand. I look forward to spending 2018 spreading that power across this industry so that we can all reap the benefits of the bigger, better picture.