3 Steps to Reduce Lost Sales

by David Metter

1. Use Data That Tells a Complete Story

The only way to know exactly where you stand in your market is to have a clear view of what you’re losing. The problem the automotive industry has faced for years now, is that both CRM and DMS data is one-sided, one-dimensional, and only shows your effectiveness against your own sales. But what about the sales of competing dealers or brands in your market? Wouldn’t it be easier to grow your market share if you knew what percentage of it you actually owned compared to your top competitors?

The other problem exists within the reporting provided by some third party vendors, as these reports only show you one side of the story – their side. In other words, what you’re winning. If you think about it, what is the most vital piece of information to have in terms of improving your dealership’s sales operations? Is it how many clicks your VDPs got or is it how many actual vehicles you sold…or didn’t sell? You be the judge.

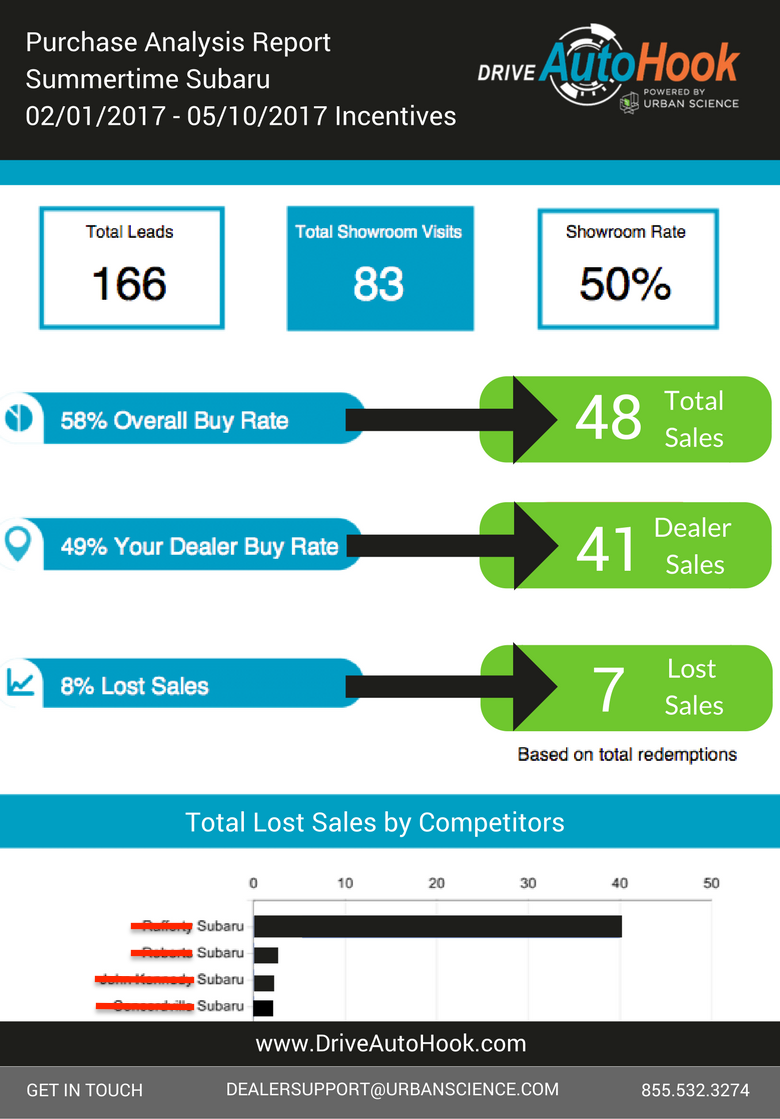

2. Accurately Quantify Your Lost Sales Opportunities

What if you could know which dealerships you’re losing sales to? How many units per day or per month are you losing to competitors? How many of your customers purchased from competing dealers or brands in your market?

It is critical for dealers to not only look at their own data and sales and defection trends, but also the sales trends of their biggest competitors. Know where you stand. If you have a clear view of what and how much you’re losing, then you have a clear view of what you need to win back.

3. Identify the Source of Lost Sales & Adjust Accordingly

There are several factors that play into each and every lost sale. What dealers need is the ability to recognize if sales are lost due to internal or external factors. For example, is there an internal problem with your sales staff or with a specific salesperson? Are your lost opportunities tied to a certain model? Or, is it an external problem such as one of your lead providers consistently delivering leads that are no longer in consideration? Look into your website traffic and the traffic providers you work with. Are these sources driving low-funnel buyers to your showroom, and can they prove it?

If you don’t know the answer to that question, it’s because you’re not seeing the full picture. You can’t fix a problem if you don’t know the problem exists. Similarly, you can’t make smarter decisions with your marketing budget if you don’t know which sources are driving bad traffic or causing high defection rates.

Now that we’ve identified all these potential problem areas, allow me to leave you with the light at the end of the tunnel. The good news is that the tools and data needed to complete the story of your market’s sales trends already exist. I know this because I’ve been on both sides of the equation. I’ve worked as the CMO of a large dealer group, and I’m currently on the vendor side of the car business. Therefore, I can say with confidence that attempting to grow your market share without a complete view of your market in today’s complex landscape is asinine. I can also say based on factual, proven stats that Urban Science has the fastest, most accurate sales match data in existence. So at the end of the day, you can go with your gut, or you can go with prescriptive science-based conviction. (I suggest the latter).

To learn more about identifying and eliminating lost sales, visit DriveAutoHook.com/TCA.