by Eric DeMont | Global Practice Director, Urban Science

If there has ever been any doubt regarding the relevance of the in-person test drive, we have confirmed loud and clear that it is here to stay. Over the summer of 2020, we worked with the Harris Poll to survey over 1,500 adults in the U.S. on how the pandemic has influenced the way they shop. As data scientists, we look for both patterns and anomalies hidden in the data that we then infuse into our informed perspectives. What we’ve learned following the permanent effects the year 2020 has had on the world is that once again, not much remains constant aside from change. This study, however, also highlighted one aspect of the vehicle purchase process that has largely remained unchanged in a year in which just about everything else had been forced to adapt.

The in-person test drive at a physical dealership is one enduring element of the car-buying process that has more than weathered the storm of COVID-19. The 2021 auto buyer still wants to experience their next vehicle purchase the same way as the 2010, 2018, 2019, and 2020 auto buyer. According to the study(1), most adults (82%) agree that there are certain elements of the vehicle purchase process that are better fit for in-person visits and cannot be done online. Of that 82%, 80% point directly to test drives as a key component of the purchase process that simply cannot be replicated in a virtual environment.

While we can’t statistically say the pandemic has had no effect whatsoever on people’s interest when it comes to digital retailing or that there aren’t consumers out there embracing the idea of moving many parts of the purchase process online, we can say the majority of adults (79%) still to this day report “they would never buy a vehicle without test driving it first.” Furthermore, 81% agree that a vehicle is too substantial of an investment to risk not seeing it in person before buying.

In November of 2020, Urban Science conducted a follow-up study(2) to evaluate consumer appetite for how they want to buy a vehicle nine months after the virus initially hit. According to the survey, despite the rise in COVID-19 cases across the U.S. during this period, 86% of consumers report being very or somewhat comfortable with buying a vehicle in person and 64% believe it’s completely safe to visit a dealership today.

Even more notable was when we asked consumers if they were ready to purchase a vehicle exclusively online, the response was a resounding “no.” While there are some aspects of the process people do prefer to complete online, most adults said that in person at a dealership is the most helpful to ensure a positive experience, especially when it comes to, you guessed it, TEST DRIVES.

Once again, both dealers and automakers have proven their resilience to change and adversity as this industry has done throughout historical recessions, pandemics, and natural disasters. Within weeks of the first U.S. case of COVID, we saw dealers quickly act to remediate the situation at hand with advertising containing language around “at-home test drives” and “we’ll bring the car to you!” Dealerships immediately stepped up their game in terms of both vehicle sanitization efforts and operational modifications to adhere to new and everchanging CDC-compliant safety protocols.

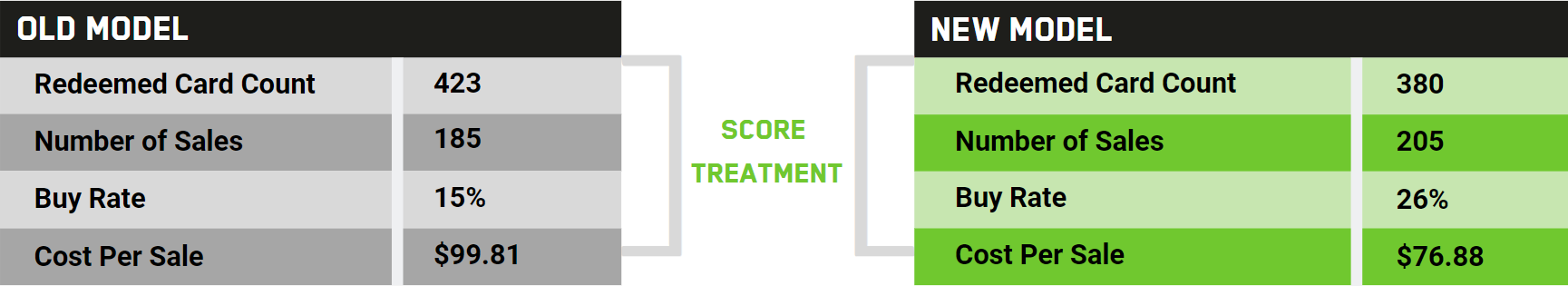

At Urban Science, we too had to adapt our test drive incentive solutions to accommodate for things like at-home test drives. We customized offers to help support local restaurants and changed our messaging to inform the public of the great measures our dealers were taking to ensure the safety of their customers. While the fundamental concept of normalcy shattered around us during this time, the collaboration and innovation that arose as a result is something that made our solutions much like the need for the in-person test drive experience, unbreakable.

In many ways, one could argue that the unrelenting impact of this global disaster has only strengthened the relationship people have with their cars. The vehicle itself has consistently been the ultimate symbol of freedom. In times of lockdown, trepidation, and uncertainty, a personal vehicle has become one of—if not the only—places people can go to escape the chaos of our new lives often stuck at home, plagued with screen fatigue. Going for a drive may be the only time and place many of us can find peace or feel free from COVID-related restrictions during times when we can no longer gather for entertainment, go out to dinner, attend a concert or sporting event…the list goes on. Perhaps more of a behavioral observation than a data point, your car is one of the best ways to get out of the house and still be safe, free, and socially distant. It would only make sense that the need to test drive a vehicle in person before making such a large commitment would prove to be pandemic-proof.

To learn more about Test Drive Solutions from Urban Science, contact Eric DeMont at ekdemont@urbanscience.com.

(1) Urban Science and The Harris Poll Joint Study, Around the Bend: How COVID-19 Impacts the Next Normal for Dealers

(2) Urban Science Online Study, The Harris Poll “Continuing Through COVID: Are Consumer Buying Intentions Changing All That Much?”, 2020

© 2021 Urban Science. All rights reserved.