As part of ongoing solution innovation initiatives, Urban Science’s Advanced Analytics team was tasked with the challenge of developing a new, technologically superior, enhanced lead scoring model to apply to AutoHook’s third-party incentive solution, also known as Lead2Show. This new, centralized model has proven to pinpoint even more leads with the highest probability of purchasing, faster and more accurately than ever before.

AutoHook’s new lead scoring model leverages the unrivaled sophistication of the Urban Science® DataHub™ - the only source of near-real-time industry-wide sales* data-fueled directly from automakers, not 90-day old registration data. Daily processing of sales and lead data allows us to deliver superior lead scoring automation technology that identifies more in-market buyers faster, without increasing the number of incentives issued.

For our dealers, this means a more efficient, cost-effective solution that eliminates instances of wasted time and money incentivizing leads with a low likelihood of purchasing or leasing a new vehicle. Simply stated, this advanced lead scoring model allows us to send even higher quality leads with the highest propensity to buy into dealer showrooms.

The direct-to-dealer benefits of our new, advanced lead scoring include:

More Sales

Higher Buy Rates

Lower Cost Per Sale

Less Waste (more buyers without increasing the number of incentives issued)

But we don’t expect you to take our word for it. In true Urban Science fashion, we have the data to prove it. We conducted extensive testing and validation efforts to confirm not only that the technology effectively does what we built it to do, but we also calculated the exact statistical significance of the implemented enhancements compared to our previous scoring model.

Methodology

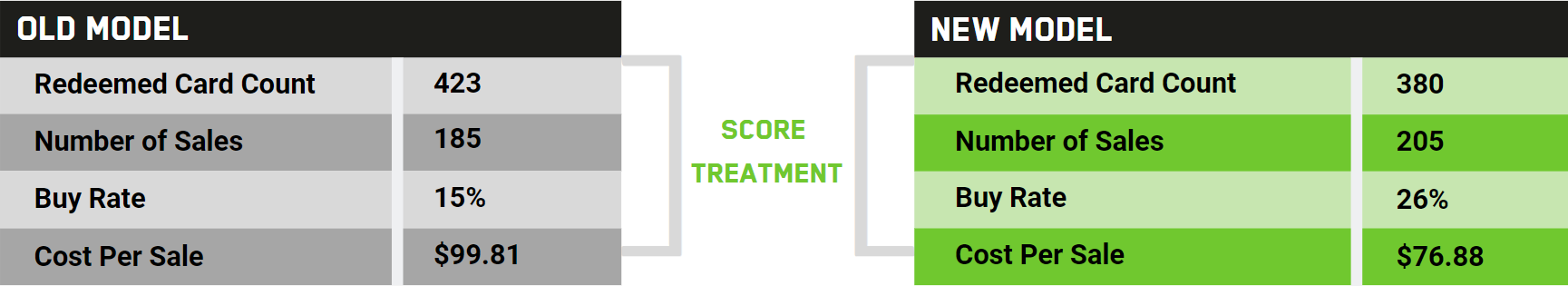

To calculate the success of the upgraded technology, we applied both scoring models to the same data set of 173,532 third-party leads across all OEM brands over a two-week period. The actual results shown below reflect only the leads that were validated to have a high likelihood to purchase and thus received an AutoHook incentive offer. The data confirmed the new and improved algorithm provides significant, quantifiable benefits to our dealers including more sales, a higher buy rate and a lower cost-per-sale.

Results

73% Higher Buy Rate

23% Reduction in Cost Per Sale

11% Increase in # of Sales

10% Reduction in Incentives Redeemed

Good news for current AutoHook clients, this upgrade in our technology is already working for you and will not affect the cost of our solutions. If you don’t use AutoHook’s third-party incentive solution (Lead2Show), for a $77 cost per sale, why wouldn’t you take advantage of this service?

*Sales refers to vehicle unit sales and does not represent vehicle price or revenue.