In efforts further enhance the online experiences of today’s mobile shoppers, Google activated their latest rule to mobile-specific website ranking. The Intrusive Interstitials Penalty, also known as the “Popup Penalty” was initiated on January 10th, 2017. Interstitials are simply a fancy word for “popups,” or any ad format that interrupts the user’s experience or access to content – an annoyance that has become all too familiar to smartphone and tablet users.

Reputable website providers and marketing companies will always remain compliant with Google’s search algorithms and ranking requirements. AutoHook works with both dealers and OEMs to drive incremental sales and showroom traffic through test drive incentive offers that are nonintrusive and that do not interrupt the user’s interaction with a page’s content. We’d like all of our clients to rest assured our solutions are NOT in violation of any aspect of Google’s mobile Popup Penalty for the following reasons:

1. AutoHook incentives cover only a small portion of the screen and are designed to integrate seamlessly into mobile websites

2. Customers do not have to take action to close or dismiss the offer

3. Our test drive incentives do not interrupt, block, or clutter the visual or content-related experience of mobile car shoppers

4. AutoHook’s technology is always run through Google’s Mobile-Friendly Test to ensure optimal conversion rates throughout the mobile environment

“Mobile best practices are at the utmost forefront of our platform's development and design, stated Joe Conrad, Program Manager for AutoHook. “We remain diligent in maintaining a proactive approach to our mobile strategy in order to stay in front of anticipated changes in the space.”

Google initiated this algorithmic change in order to penalize any website or technology provider that does not adhere to the new rule. According to Google, “Pages where content is not easily accessible to a user on the transition from the mobile search results may not rank as highly.” Ranking lower down the page in search results, especially on mobile, can drastically affect both your website traffic and your overall business.

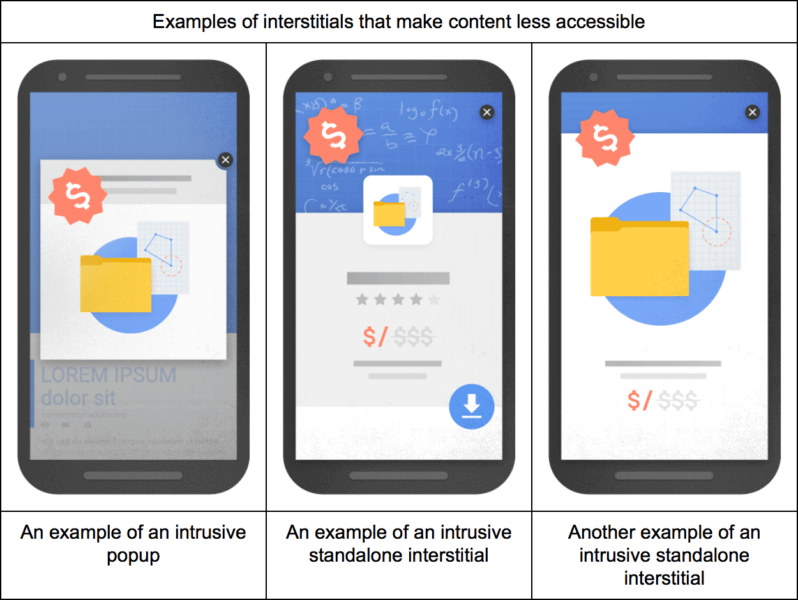

So how do you know if your site is in violation? Below is the list Google provided of all interstitials that could be potentially problematic to the user:

- Showing a popup that covers the main content, either immediately after the user navigates to a page from the search results, or while they are looking through the page.

- Displaying a standalone interstitial that the user has to dismiss before accessing the main content.

- Using a layout where the above-the-fold portion of the page appears similar to a standalone interstitial, but the original content has been inlined underneath the fold.

Google also gave us visual examples of ads or offers that violate the Popup Penalty:

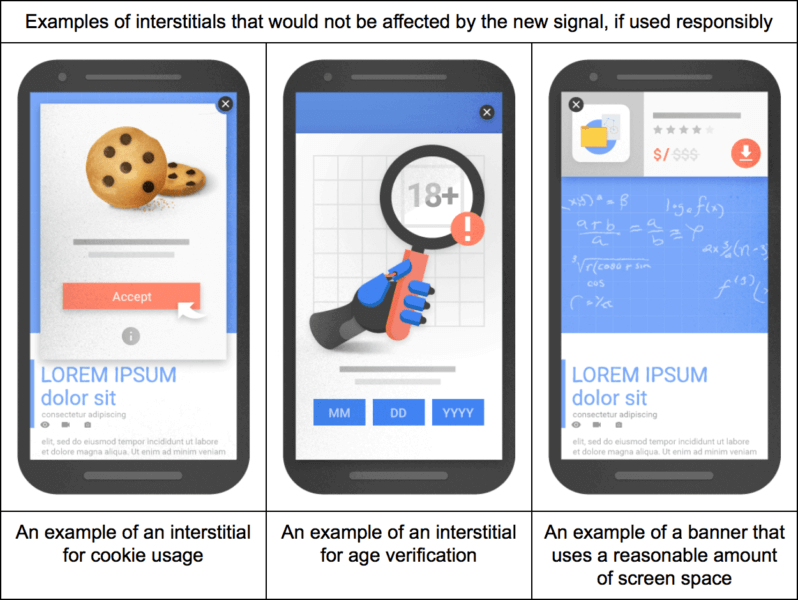

There are three types of interstitials that do not violate this rule, and thus would not be ranked lower in search results. Google listed the following types of popup banners or overlays that they do allow, and that will not be negatively affected:

- Interstitials that appear to be in response to a legal obligation, such as for cookie usage or for age verification.

- Login dialogs on sites where content is not publicly indexable. For example, this would include private content such as email or unindexable content that is behind a paywall.

- Banners that use a reasonable amount of screen space and are easily dismissible. For example, the app install banners provided by Safari and Chrome are examples of banners that use a reasonable amount of screen space.

Google’s mentality when it comes to ad and website ranking is incredibly simple. Relevancy gets rewarded, and any disconnects in messaging from one page to the next will not be tolerated (at least not for long). We are proud to say that AutoHook is, and always will be compliant with Google’s website ranking standards.

If you have any concerns regarding your mobile site ranking, you can test it here with Google’s Mobile-Friendly Test.